Tuition Information

Tuition information for the 2025-26 school year

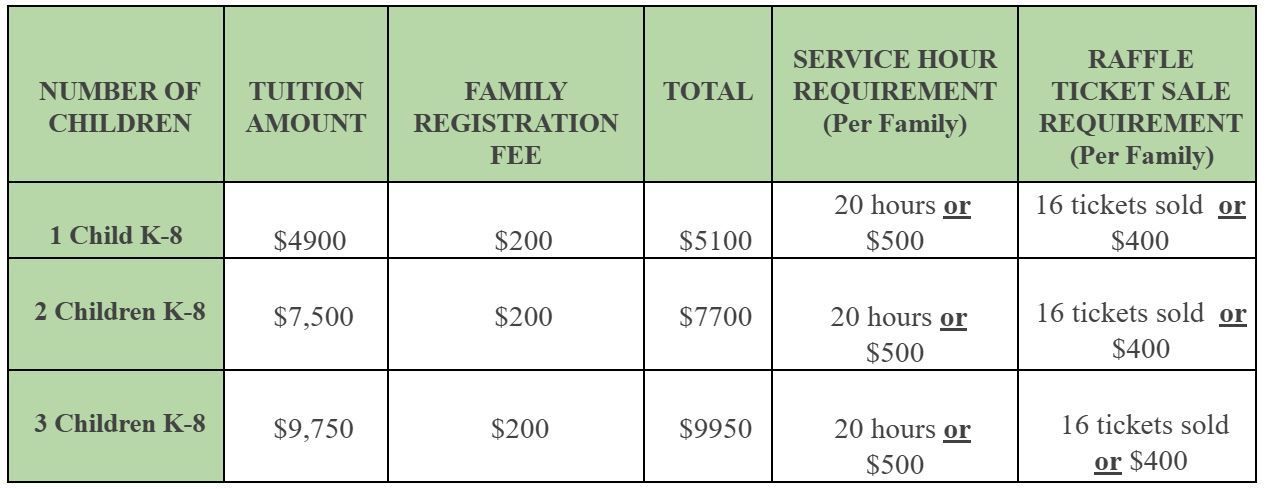

Kindergarten - 8th Grade Tuition

The parish subsidizes the difference between the cost of educating each child and the tuition collected from each family. Last year, each child in the school was given a parish scholarship to make up the difference.

Raffle Ticket Sales are for Preschool thru 8th grade families. A minimum of sixteen tickets are to be sold per school family, or $400 per family will be added to the total tuition balance due.

K-8 Non-Parishioner Tuition: Students who are not parishioners of Christ the King pay the same tuition, fees, service hour requirement, and raffle ticket requirement as students who are parishioners. Additionally, there is a $1500 surcharge per family. This surcharge is billed to parishes without schools so long as the family is an active parishioner. Families belonging to parishes with schools that are not Christ the King OR that are of other faith traditions will have the surcharge automatically added to their tuition bill.

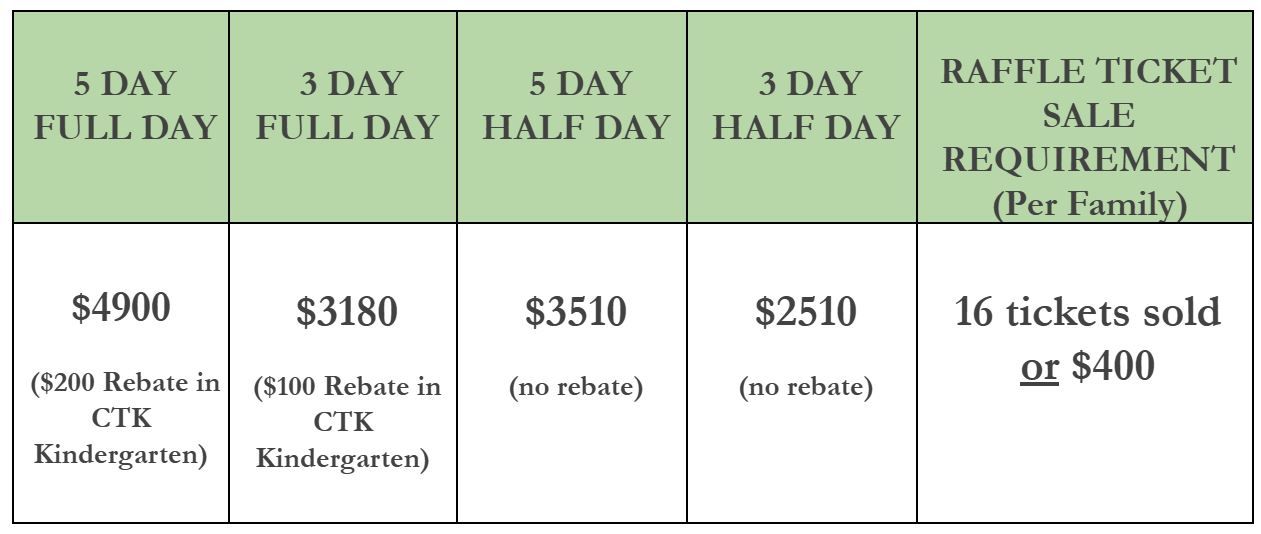

Preschool Tuition

Raffle Ticket Sales are for Preschool thru 8th grade families. A minimum of sixteen tickets are to be sold per school family, or $400 per family will be added to the total tuition balance due.

Rebate Information

Note: For our preschool program, there is a $100 Kindergarten rebate if enrolled in our all day 3 day a week program and a $200 Kindergarten rebate if enrolled in our All Day 5 Day a week program. This rebate will be applied to your Christ the King Kindergarten tuition.New Paragraph

AWP: Assistance to Working Parents

Before and After School Care

To assist our working parents, we offer a before and after school care program (AWP or Assistance to Working Parents).

Before school care begins as 7:00 a.m. and after school care goes until 5:30 p.m.

See more information about our before and after school care options: AWP Information

Annual AWP Enrollment Fee

$40 Per Student

Before School, 7:00 AM - 7:45 AM, or arrives before 7:45 AM

$5 per day per child

After School, 3:00 PM - 5:30 PM

$10 per day per child

Pick up after 5:30 PM

$1 per minute after 5:30 PM per Child

RaiseRight Gift Card Program

Participating in our gift card program can help reduce your tuition.